Overseas financial activity of Russian HWNIs — a Tranio and EY joint survey, 2019

An increasing number of Russian HNWIs (high-net-worth-individuals) are notifying Russia’s tax authorities about their foreign bank accounts and controlled foreign corporations (CFCs). This follows Russia’s adoption of the Common Reporting Standards (CRS) in 2016, which facilitates the automatic exchange of information regarding bank accounts between partner countries’ tax authorities in a bid to combat tax evasion.

Wealthy Russians who do not want to disclose their assets mostly obtain tax residency in countries with stronger economies, while the tendency to transfer capital to nominal owners is in decline.

This report is the result of a joint survey conducted at the end of 2019 by Tranio and EY (Ernst & Young) Russia, involving 44 specialists from the private banking, law, and tax consulting sector who work with Russian HNWIs.

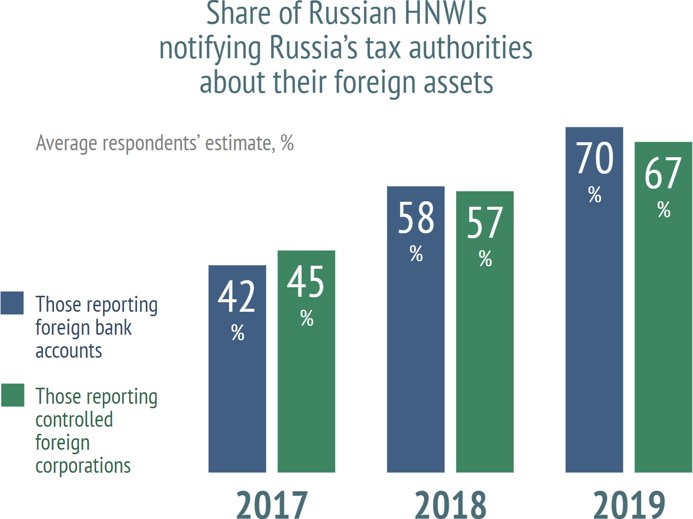

More Russians are notifying tax authorities about their foreign assets

On average, respondents estimated that 70% of Russian HNWIs notified Russia’s tax authorities about their foreign bank accounts in 2019, while 67% are estimated to have notified the authorities about their CFCs.

If we compare these numbers with the results of Tranio’s surveys over the last few years, we can see that both indicators have grown steadily since 2016, when Russia joined the CRS Multilateral Competent Authority Agreement (MCAA). On average, the share of Russian HNWIs reporting their foreign accounts has increased by 14 percentage points every year, while the share of those reporting their CFCs has risen by 11 percentage points each year.

In 2018, the Federal Tax Service of Russia received the first data on the foreign bank accounts of Russian tax residents. I don’t think the tax authorities have enough resources to process all the information they’ve received, however, as the skills, practices, and instruments of automation of Russia’s tax authorities improve, they will gradually use this data more effectively in order to increase the volume of tax collected from Russians’ foreign incomes.

Naturally, Russia’s tax authorities will primarily be interested in cases involving larger amounts of money, but eventually they will also focus on less high profile cases.

The steady rise of the number of Russians reporting both foreign accounts and CFCs can be explained by the fact that more HNWIs understand that if they want to remain a tax resident of Russia, they need to notify the authorities. There’s only one legal alternative: stay in Russia for no longer than 183 days a year and cease to be a tax resident.

Russian HNWIs are investing in bonds and real estate

A total of 79% of respondents said Russian HNWIs invested the most money in bonds in 2019. Not far behind was income real estate, which was chosen by 62% of respondents. The least popular investment assets in the questionnaire were precious stones and metals (13%) and lifestyle (luxury real estate, yachts, antiques, art objects, etc. – 21%).

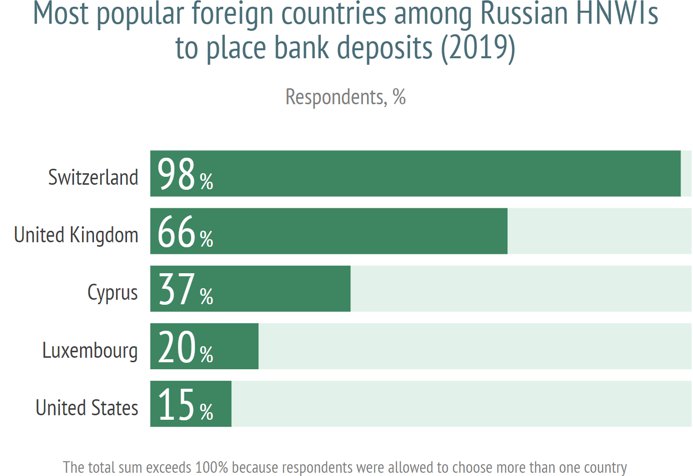

Respondents said many Russian HNWIs keep their money in Switzerland and withdraw assets from Cyprus

An overwhelming majority of respondents (98%) named Switzerland as the foreign country where wealthy Russians prefer to have bank accounts. The second most popular country is the UK (66%) by a wide margin, while 37% chose Cyprus. Switzerland and Cyprus share financial information with Russia as part of the CRS MCAA, however, the UK terminated the exchange of financial information in 2019. These three countries were also listed in previous Tranio surveys as the preferred locations for transferring money out of Russia. Luxembourg and the United States are the fourth and fifth most popular countries.

Other countries where Russians keep deposits were also mentioned by two or more respondents each – there were Austria, Germany, Liechtenstein, Monaco, the UAE, and Singapore.

Meanwhile, fewer Russians were apparently depositing assets in Cyprus, with 39% of respondents saying that Russians are withdrawing assets acquired in Cyprus. Trust in Cyprus was undermined back in 2013 – after hard fought negotiations between the government and Eurogroup, Laiki Bank lost all deposits over €100,000, while the Bank of Cyprus (BoC) lost 47.5% of deposits over €100,000, as part of the country’s bailout conditions dictated by the EU and IMF.

Apart from Cyprus, Russians are withdrawing assets from the Baltic states, which were mentioned by 30% of respondents, especially Latvia. Baltic banks are now weary of dealing with Russian capital, following a series of scandals involving suspected money laundering. In 2018, Latvia’s ABLV Bank started the process of voluntary liquidation – the investigation into fraud has also affected branches of Swedbank and Danske Bank in Estonia. In January 2020, searches were conducted in several other Latvian banks that serviced deposits of foreigners (Russians and Belorussians in particular).

Foreign banks, including those in the Baltic states, are tightening compliance and now handle money from Russia incredibly carefully in line with anti-money laundering procedures.

Even if someone tries to deposit money that was earned legally and provides all the necessary documents to prove its origin, the banks will examine them top to bottom to observe strict protocols.

Foreign banks are looking for any reason to reject applications for loans or deposits – they are protecting themselves from possible sanctions by regulators.

Russian HNWIs are increasingly changing their tax residency from Russia

A total of 79% of respondents said Russian HNWIs are increasingly becoming tax residents of foreign countries. In Tranio’s 2017 survey, the figure was almost exactly the same at 78%.

Almost half of all respondents (45%) said that Russian HNWIs are increasingly moving their assets away from Russia, while 37% of respondents said Russian HNWIs participate in Russia’s capital amnesty programme. The third phase of the programme was conducted from June 1, 2019 to February 29, 2020 and stipulated a transfer of previously undeclared foreign deposits to Russia and a re-domiciliation of CFCs.

Transferring assets to nominal owners proved the least popular option – only 18% respondents believe that it is growing as a trend. In the 2017 survey, the figure was higher at 35%.

Anton Ionov, Partner, CIS Personal Tax Leader, EY Moscow

“More countries are exchanging information following the Common Reporting Standard (CRS). Information about companies’ accounts and their beneficiaries is transmitted to the tax authorities of the country where the final beneficiary has their tax residency. In practice, foreign banks refuse to open accounts if the client does disclose the final beneficiary of the ownership structure.

In many countries, lists of real business owners are being mandatorily compiled. This information helps tax authorities identify unscrupulous taxpayers who use nominal owners and other artificial schemes to evade taxes.”

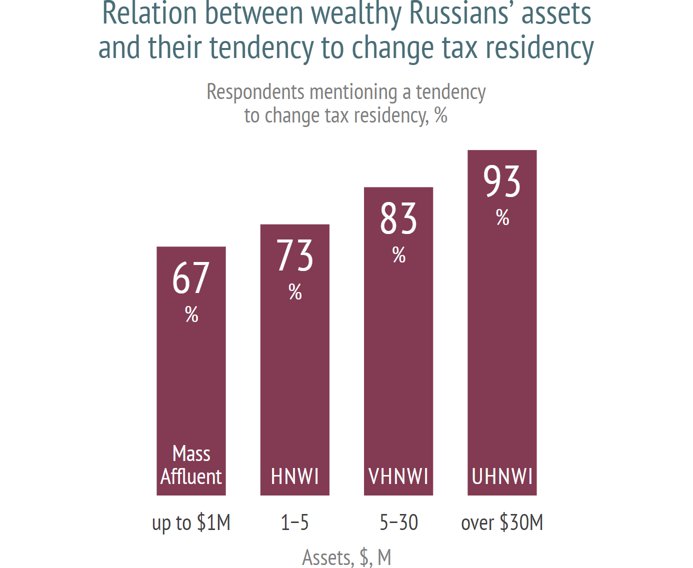

The results of the survey show a stable relationship between the level of capital and the tendency of HNWIs to change their tax residency – the wealthier the individual, the higher the tendency to change tax residency. For example, 67% of respondents who work with mass affluent clients (assets up to $1M) noted the trend of HNWIs changing their tax residency, compared to a total of 93% of respondents who work with ultra HNWIs (more than $30M) noting the trend.

A similar correlation could also be observed in previous Tranio surveys.

Anton Ionov, Partner, CIS Personal Tax Leader, EY Moscow

“In reality, I don’t see a direct correlation between a person’s desire to change their tax residency and their level of prosperity. In theory, such a correlation may be related to the fact that more prosperous individuals have a more difficult structure of businesses and operations so rarely qualify for CFC tax exemption, and therefore generally face higher risks related to compliance with Russia’s currency legislation.

There are other factors that correlate with the level of an individual’s wealth and their desire to move to another country. For example, security issues, asset protection, business conditions, and political climate.”

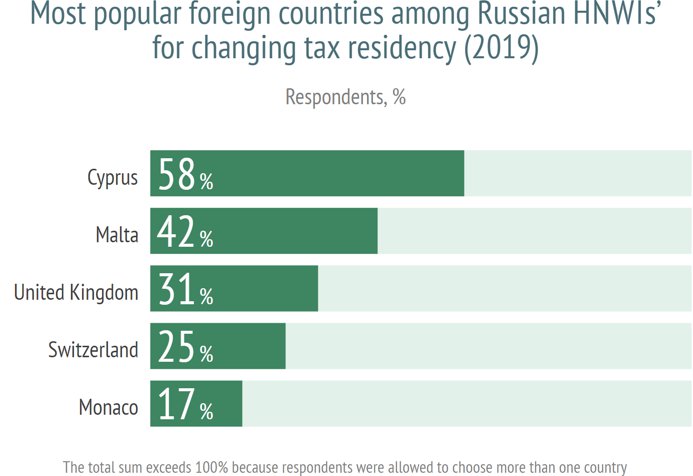

The most popular countries for changing tax residency are Cyprus (58% respondents), Malta (42%), and the United Kingdom (31%), followed by Switzerland and Monaco. In addition, two or more of the respondents named Israel, Spain, Luxembourg, the UAE, and the United States.

Cyprus remains an attractive jurisdiction for tax residency despite its deteriorating banking climate. The advantages are as follows:

- tax residents only need to stay on the island for 60 days a year;

- corporate tax is only 12.5%;

- capital gains tax is only levied when Cypriot real estate (or a company that owns Cypriot real estate) is being sold;

- no tax on dividends.

I think that Malta is on the list due to its popular ‘golden passports.’ The demand for other countries is explained by a combination of historical interest, the quality of location, low taxes for non-residents, the availability of inexpensive Russian-speaking consultants, and convenient logistics.”

A total of 32% of respondents say that the UK is losing its popularity as a jurisdiction for changing tax residency faster than any other country. This decline is not only linked to Brexit, but also to changes in tax legislation, which is forcing foreigners permanently to pay tax on income received outside of the country.

For example, many foreigners who permanently resided in the UK were previously exempt from paying tax on income earned outside of the country, and since 2017 there have been fewer reasons for exemption from these taxes.

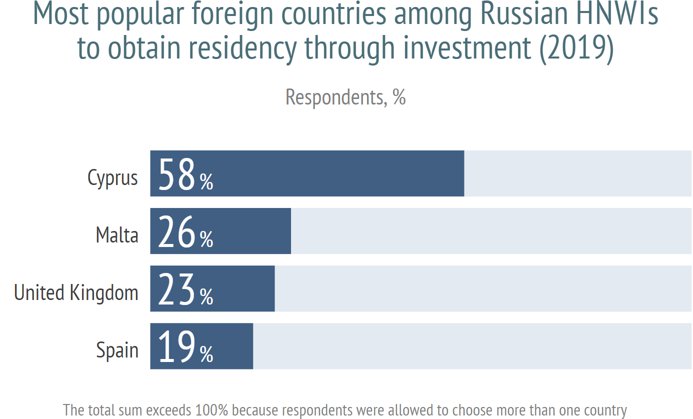

Cypriot ‘golden passports’ in highest demand

More than half of the respondents named Cyprus as a country where Russian HNWIs acquire residency or citizenship through investment. Malta, the UK, and Spain follow Cyprus but are behind by a large margin.

Germany, Greece, Portugal, Saint Kitts and Nevis, and Switzerland were highlighted by two respondents each.

The Cypriot “Golden Visa” programme has been in effect since 2016 and enables foreigners to acquire citizenship for themselves and their family if they invest €2M into the country. Cypriot citizens can visit more than 170 countries visa-free, including those in the European Union, Canada, and Australia.

However, interest in “golden passports” issued by Cyprus may also decline following the scandal that occurred in November 2019, when the Cypriot government revoked the citizenships of 26 investors, nine of whom were Russian.

Anton Ionov, Partner, CIS Personal Tax Leader, EY Moscow

“New Cypriot citizens have been repeatedly scrutinised for their compliance with the programme conditions, and some have even had their passports cancelled, which has cooled the interest of potential applicants.

Historically, a lot of Russian businesses have been linked with Cyprus and at the moment Cyprus is experiencing an influx of Russian workers — both specialists and managers who previously operated remotely from outside the country, but are now based on its territory to ensure their companies’ economic presence (substance), while also justifying their companies’ corporate tax residency.”

We will send you a content digest not more than once a week